The digital wallet market share has seen explosive growth in 2025, driven by rapid technological innovation, shifting consumer behavior, and an ever-expanding cashless economy. Whether you’re a business owner, fintech professional, or just a curious consumer, understanding how the market is evolving can offer valuable insights.

In this post, we’ll dive deep into the mobile wallet market share, explore top-performing digital payment providers, and unpack trends that are shaping the future of the global digital wallet market.

🔍 What Is a Digital Wallet?

A digital wallet (or e-wallet) is an app or online service that allows you to make electronic transactions. It can store digital versions of your credit/debit cards, loyalty cards, and even cryptocurrency.

Think Apple Pay, Google Pay, Paytm, PhonePe, and Venmo. These apps let you pay at stores, transfer money, or shop online without ever opening your physical wallet.

📊 Digital Wallet Market Share: 2025 Snapshot

As of mid-2025, digital wallets dominate both online and offline payment systems globally. Here’s a quick look at how digital wallet market share is distributed among the top digital wallet providers:

| Provider | Global Market Share (2025) | Regions Dominated |

|---|---|---|

| Apple Pay | 18.2% | North America, Western Europe |

| Google Pay | 14.9% | India, Southeast Asia, USA |

| PayPal | 13.5% | USA, UK, Germany |

| PhonePe | 12.3% | India |

| Paytm | 11.7% | India |

| Samsung Wallet | 7.6% | South Korea, USA, EU |

| Alipay | 6.2% | China (declining outside China) |

| Amazon Pay | 4.1% | USA, India |

| Others (regional apps) | 11.5% | Latin America, Africa, UAE, etc. |

Source: Aggregated from 2025 fintech market reports and analytics firms.

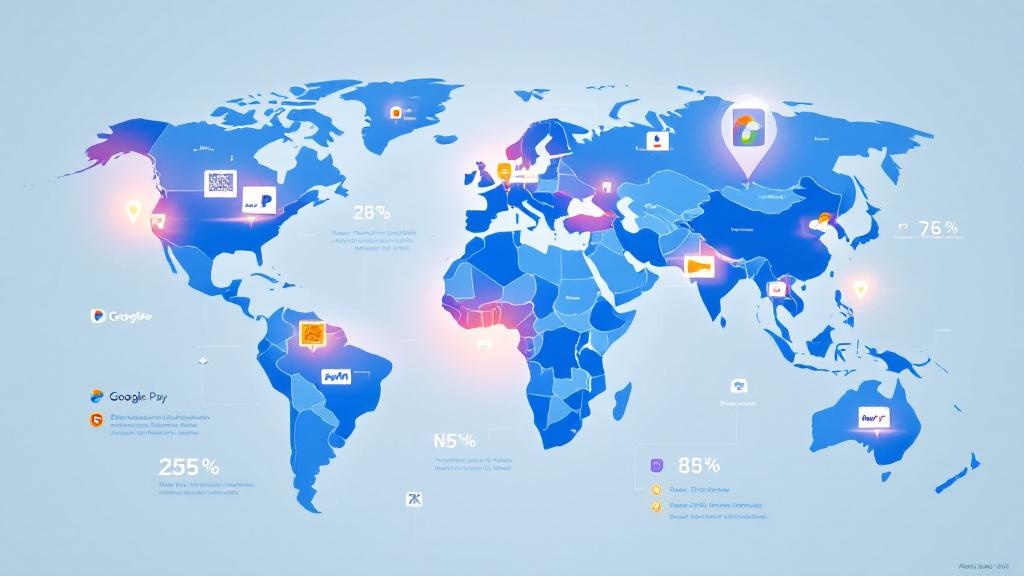

🌍 Regional Overview: Mobile Payment Apps Market Share

📱 India: The Reign of UPI Wallets

India is now the largest mobile payments adoption market, thanks to UPI (Unified Payments Interface) and a booming fintech ecosystem.

-

PhonePe leads the pack with over 46% UPI wallet market share

-

Paytm follows closely at around 38%

-

Google Pay commands about 14% of UPI transactions

This explosive growth is largely due to the Indian government’s push toward a cashless economy, QR code adoption, and mobile-first banking.

🇺🇸 USA: Apple Pay and PayPal Dominate

In the U.S., Apple Pay is the most used contactless payment market provider, accounting for nearly half of all smartphone payment usage in retail settings.

-

Apple Pay: Widely accepted and used in-store

-

PayPal: Still strong in e-commerce payment methods

-

Venmo (owned by PayPal): Popular among younger users for P2P transfers

🌏 Southeast Asia: A Competitive Fintech Ecosystem

-

GrabPay, ShopeePay, and Google Pay dominate countries like Singapore, Indonesia, and Malaysia.

-

Wallet app downloads in the region grew by over 28% YoY in early 2025.

📈 Top Trends in the Digital Payment Market Share (2025)

1. QR Code Payment Systems Are Ubiquitous

Thanks to their low cost and ease of deployment, QR code payment systems have surged in popularity — especially in markets like India, China, and Africa.

Example: Even local vegetable vendors in rural India now accept QR-based UPI payments through Paytm or PhonePe.

2. NFC and Contactless Transactions on the Rise

Near Field Communication (NFC) technology has powered much of the growth in contactless transactions in mature markets.

-

Apple Pay, Samsung Wallet, and Google Pay all support NFC-enabled devices

-

Retailers are upgrading POS systems to enable tap-and-go features

3. Digital Transaction Volume Hits New Highs

-

Global digital transaction volume is projected to exceed $18 trillion in 2025

-

The mobile wallet market share of total online transactions is now over 56%

4. Fintech Startups Fuel Innovation

While big players dominate, emerging fintech apps are disrupting niche markets — especially in Africa, South America, and Eastern Europe.

-

M-Pesa in Kenya

-

NuBank Pay in Brazil

-

PayU in Eastern Europe

💼 Why Businesses Should Care About Digital Wallet Market Share

Understanding e-wallet usage statistics isn’t just for analysts — it has direct business applications:

-

Retailers can tailor checkout systems for top digital wallets in their region

-

E-commerce stores that offer wallet payments often see higher conversion rates

-

Fintech entrepreneurs can identify gaps or underserved regions in the market

💡 Real-Life Example: India’s Cashless Push

When India removed 500 and 1000 rupee notes during demonetization in 2016, it sparked a nationwide push for digital wallets. Fast-forward to 2025, and:

-

Over 90% of urban India uses digital wallets for everyday purchases

-

Rural adoption is catching up thanks to UPI, affordable smartphones, and mobile internet

PhonePe and Paytm capitalized on this early, using aggressive merchant onboarding and cashback offers.

📲 Future Outlook: What’s Next for Leading Digital Wallets in 2025?

🔮 Predictions:

-

Biometric payments and voice-enabled transactions will gain traction

-

Integration of AI and ML to offer personalized financial insights

-

Rise of multi-currency and crypto wallets for international travel and cross-border payments

-

Super apps like PhonePe and Grab expanding into insurance, lending, and investing

❓FAQs About Digital Wallet Market Share in 2025

1. Which digital wallet has the largest global market share in 2025?

Apple Pay leads the global digital wallet market share at 18.2%, especially in developed markets like the US, UK, and EU.

2. How does UPI influence mobile wallet market share in India?

UPI has revolutionized mobile payments in India. Apps like PhonePe and Paytm gained large UPI wallet market share by offering QR payments, instant bank transfers, and cashback.

3. What are the top digital wallet providers in 2025 globally?

The top digital wallets include:

-

Apple Pay

-

Google Pay

-

PayPal/Venmo

-

PhonePe

-

Paytm

-

Samsung Wallet

-

Alipay

4. Is the contactless payment market growing in 2025?

Yes. Contactless transactions using NFC and QR codes are up over 30% YoY in many regions due to hygiene, speed, and convenience.

5. What role does smartphone penetration play in wallet adoption?

High smartphone payment usage directly correlates with digital wallet adoption. Regions with growing smartphone access, like Africa and Southeast Asia, are seeing rapid wallet adoption.

6. How is the fintech ecosystem influencing digital payment market share?

The fintech ecosystem is the backbone of digital wallet growth. From APIs to KYC services and embedded finance, fintech innovation drives user adoption and retention.

7. Are mobile payments replacing credit/debit cards?

In many regions, yes. In countries like China and India, mobile payments adoption has overtaken plastic cards for daily use.

🧾 Conclusion: Who’s Winning the Digital Wallet War?

The race for digital wallet market share in 2025 is far from over. While Apple Pay, Google Pay, and PayPal dominate globally, regional players like PhonePe, Paytm, and Alipay are holding strong in their home markets.

As cashless economy growth continues, and users embrace contactless transactions, digital wallets will become not just convenient—but essential.

Whether you’re a consumer looking for faster payments, or a business eyeing new payment solutions, staying informed about the digital wallet landscape in 2025 will give you a competitive edge.

Comments (0)