Capital gains tax is a critical aspect of investing that often goes underappreciated until tax season arrives. Did you know that for many people, capital gains from the sale of assets can significantly affect their overall tax liabilities? As economic landscapes change and asset values fluctuate, understanding capital gains tax becomes essential for maximizing your investment returns. This comprehensive guide will demystify capital gains tax, covering everything from its types and calculations to global perspectives and future trends, helping you navigate the complexities of this important tax obligation with confidence. Whether you’re a seasoned investor or just starting out, gaining clarity on capital gains tax will empower you to make better financial decisions and enhance your wealth-building strategies.

What is Capital Gains Tax?

Capital gains tell is a tax levied on the profit realized from the sale of non-inventory assets, which can include stocks, bonds, real estate, and other investments. Understanding capital gains tax is essential for anyone involved in investing or real estate, as it directly impacts your returns and overall financial planning.

Types of Capital Gains

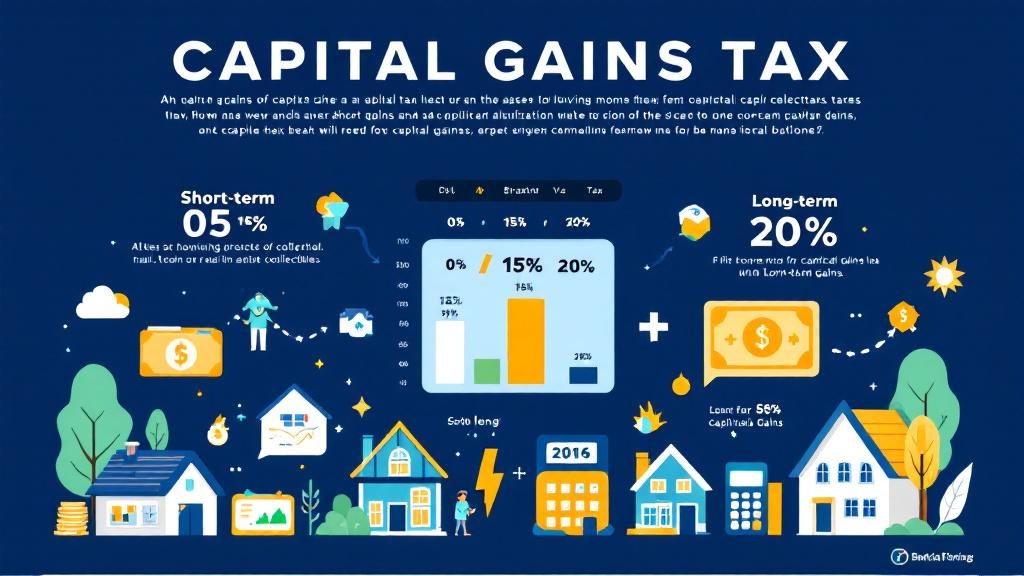

When discussing capital gains, it’s important to differentiate between the two primary types:

Short-term Capital Gains

These occur when you sell an asset held for one year or less.

-

Taxed at your regular income rate, which can be considerably higher.

-

Often associated with rapid trading strategies or quick property sales.

Long-term Capital Gains

Refers to profits from assets held for over one year.

-

Benefits from reduced rates, offering more favorable treatment than short-term profits.

-

Encourages a strategy of holding investments longer to maximize returns.

How Capital Gains Are Calculated

While the process of calculating capital gains can be straightforward, it requires attention to detail:

-

Identify Your Capital Assets: Determine which investments or properties are considered capital assets.

-

Calculate the Gain:

-

Selling Price: The amount you sold the asset for.

-

Purchase Price: The original cost of the asset.

-

Allowable Expenses: Deduct any costs associated with the sale (e.g., broker fees, repair costs).

-

-

Determine Your Income Bracket: Capital gain rates vary based on income levels and asset holding duration.

Common Tax Brackets:

-

0% for those in the lowest income group

-

15% for most taxpayers

-

20% for those in the highest bracket

Exemptions and Deductions Related to Capital Gains

Various exemptions and deductions can significantly reduce your financial liability:

-

Primary Residence Exemption: If you sell your primary home, you may exclude up to $250,000 ($500,000 for married couples) of gains.

-

Specific Investments: Certain exemptions may apply to collectibles or other specific assets, altering your liability.

-

Loss Offsetting: If you’ve experienced losses in investments, you can offset these against your gains, reducing your overall liability.

For comprehensive details, refer to the IRS website for necessary forms and guidelines.

Reporting Capital Gains

Accurate reporting is essential for compliance and avoiding penalties. Here’s how you can manage your reporting obligations:

Required Forms and Documentation:

-

Form 8949: This form is used to report sales and dispositions of capital assets.

-

Schedule D: This form summarizes all capital transactions reported on Form 8949 and helps calculate your overall gains or losses.

Due Dates for Filing:

Typically, tax returns are due by April 15th of the following year, with adjustments made if the date falls on a weekend or holiday.

Common Mistakes to Avoid:

-

Failing to report all sales, even losses

-

Incorrectly calculating profits or losses

-

Omitting required forms like Form 8949 and Schedule D

By staying organized, you can effectively manage your capital obligations and minimize any potential issues. Check the H&R Block website for more resources.

The Impact of Capital Gains on Investment Strategies

Capital gains considerations are vital when forming an investment strategy. The implications can heavily influence decision-making and overall financial returns.

Tax Implications for Different Investments

Various asset types face different capital gain rates, so it’s important to consider how each investment fits into your portfolio:

-

Stocks:

-

Short-term trades may result in higher financial liabilities.

-

Holding stocks for over a year may reduce your burden by qualifying for lower long-term rates.

-

-

Real Estate:

-

Rental properties can be subject to both short-term and long-term rates, depending on how long you’ve held the property.

-

Primary residence exemptions can help minimize your obligations when selling your home.

-

-

Bonds:

-

Selling bonds can generate capital profits, though municipal bonds may be exempt from federal charges.

-

Strategies to Minimize Liabilities:

-

Tax-Loss Harvesting:

Selling assets that have underperformed to offset gains from profitable ones. -

Holding Period Management:

Waiting for more than a year before selling an asset to benefit from reduced rates. -

Tax-Advantaged Accounts:

Investing through retirement accounts like IRAs or 401(k)s defers any capital gains obligations until withdrawals are made.

By implementing these strategies, investors can manage their returns while reducing liabilities. Check out the Charles Schwab website for more tools and advice.

Global Views on Capital Gains Regulations

Capital gains laws differ globally, influencing investment strategies for those dealing with international markets. Here’s how tax rates vary:

Comparing Capital Gains in Different Countries:

-

United States:

-

Long-term rates range from 0% to 20%, based on income.

-

Short-term gains are taxed at regular income rates.

-

-

United Kingdom:

-

Rates range from 10% to 20%, with primary residence exemptions.

-

-

Canada:

-

Only 50% of capital gains are taxable, with the remaining amount exempt, taxed at the individual’s income rate.

-

-

Germany:

-

Capital profits are taxed at a flat rate of 26.375%.

-

-

Australia:

-

A 50% discount applies to long-term gains (held over a year), while short-term profits are taxed at regular rates.

-

Understanding these differences helps investors make informed decisions regarding their international investments.

Future Trends in Capital Gains Regulations

As tax laws evolve, staying informed about potential changes can help you plan effectively for the future.

Potential Changes:

-

Increase in Rates:

Some policymakers are proposing higher rates for capital gains to address social issues, affecting higher-income earners more significantly. -

Adjustment in Holding Periods:

There may be efforts to extend the holding period for long-term capital gains, discouraging short-term trading. -

Simplification of Rates:

A uniform rate for both long-term and short-term gains could simplify the system.

Impacts on Investors:

-

Investment Decisions:

Higher rates may prompt investors to hold onto assets longer, affecting market dynamics. -

Strategic Adaptations:

Investors will need to adjust strategies to account for potential increases in liability.

As legislation changes, remaining proactive and informed is key to managing your financial situation. For expert insights, visit the Deloitte Insights website for updated resources and articles.

Resources for Further Learning

As capital gains tax remains a critical aspect of financial planning and investment strategy, leveraging reputable resources can help taxpayers educate themselves about their obligations and opportunities. Here are some recommended resources for further learning about capital gains tax:

Books and Online Resources

Reading in-depth material can provide valuable insights into capital gains tax. Consider these options:

- “The Complete Guide to Capital Gains Tax” by various authors: This book offers comprehensive explanations and examples pertaining to capital gains tax dynamics.

- IRS Publications: The Internal Revenue Service provides clear and authoritative tax-related guides, including those specifically relating to capital gains taxation. Refer to IRS Publication 550 for detailed info.

- Online Tax Blogs and Websites: Reputable financial advice websites often publish articles and guides about capital gains tax. Websites like Investopedia break down complex topics into understandable segments.

Professional Organizations and Government Websites

Utilizing professional organizations can be beneficial for staying updated on tax legislation and best practices:

- National Association of Tax Professionals (NATP): Offers resources and training for tax professionals and taxpayers alike.

- American Institute of CPAs (AICPA): This organization provides information on tax preparation and advocacy around tax policies that can impact capital gains tax.

Tools for Calculating Capital Gains Tax Online

Several online calculators can assist in estimating your capital gains tax liability:

- Tax Act Calculator: This user-friendly tool helps determine capital gains based on your input data, providing quick estimates.

- TurboTax Capital Gains Tax Calculator: Offers a detailed insight into how much you may owe in capital gains tax, factoring in different scenarios.

By utilizing these resources, you can better navigate the complexities of capital gains tax and make informed decisions regarding your investments and financial strategies.

Understanding Capital Gains Tax in the Context of Other Taxes

Capital gains tax plays a crucial role in the broader landscape of taxation, and understanding its context can help taxpayers navigate their financial responsibilities more effectively. Here, we’ll explore how capital gains tax interacts with other types of taxes and the implications for taxpayers.

Relationship Between Capital Gains Tax and Income Tax

One of the most notable aspects of capital gains tax is its interaction with income tax:

- Tax Rates:

- Short-term capital gains are taxed at the ordinary income tax rate, which can be significantly higher than the long-term capital gains tax rates. This distinction emphasizes the financial benefits of holding investments longer.

- Impact on Tax Bracket:

- Selling an asset and realizing a capital gain can impact your total taxable income, potentially pushing you into a higher tax bracket, especially if significant gains are realized in a single tax year.

Capital Gains Tax vs. Estate Tax

Another important relationship to understand is between capital gains tax and estate tax:

- Realization Upon Death:

- In many countries, when an individual passes away, their assets are typically revalued at current market value, and beneficiaries may not be liable for capital gains taxes on those assets until they sell them. This is known as a “step-up in basis.”

- Planning Strategies:

- Effective estate planning can help minimize the impact of capital gains tax on heirs, ensuring that wealth transfers occur in a tax-efficient manner.

Capital Gains Tax Implications for Retirement Accounts

Retirement accounts also influence capital gains tax liabilities:

- Tax-Deferred Accounts:

- Investments within accounts like IRAs or 401(k)s accumulate without immediate capital gains tax consequences, allowing for potential growth without annual tax liability.

- Taxation Upon Withdrawal:

- However, upon withdrawal from these accounts, distributions may be taxed at ordinary income tax rates, regardless of whether the growth involved capital gains.

Understanding how capital gains tax intersects with other types of taxes can help you make well-rounded financial decisions. For deeper insights into comprehensive tax planning, visit the Fidelity Investments website, which provides extensive resources on investment strategies and tax implications.

Common Misconceptions About Capital Gains Tax

Understanding capital gains tax is vital for effective financial planning, yet several misconceptions can lead to confusion and poor decision-making. Addressing these myths can provide clarity and enable individuals to better navigate their tax obligations.

Misconception 1: All Gains Are Taxed at the Same Rate

One popular myth is that all capital gains are taxed at the same rate, regardless of how long the asset was held. In reality:

- Short-Term vs. Long-Term:

- Short-term capital gains (assets held for one year or less) are taxed at your ordinary income tax rate, which is often higher.

- Long-term capital gains (assets held for more than one year) benefit from reduced tax rates, typically ranging from 0% to 20% based on your income.

Misconception 2: You Only Pay Capital Gains Tax When You Sell

Another common misconception is that capital gains tax applies only when an asset is sold. However:

- Realization Principle:

- While you incur a capital gains tax liability upon selling an asset, certain investments, such as mutual funds, may distribute capital gains to shareholders without them selling their shares, thus incurring tax liabilities.

Misconception 3: Losses Are Useless in Capital Gains Tax

Many people believe that if they incur losses, they cannot offset them against their gains. However:

- Tax-Loss Harvesting:

- Taxpayers can offset capital gains with capital losses to reduce their overall tax liability. This strategy, known as tax-loss harvesting, allows investors to sell losing investments to cushion the impact of taxable gains.

Misconception 4: Capital Gains Tax Does Not Affect Retirement Accounts

Some think that retirement accounts are immune to capital gains tax, but the truth is more nuanced:

- Tax-Deferred Growth:

- Investments made within retirement accounts like IRAs and 401(k)s grow without immediate capital gains tax consequences. However, withdrawals from these accounts are typically taxed as ordinary income, regardless of the source of growth.

Busting these common misconceptions about capital gains tax can empower individuals to make better-informed financial decisions. For further clarification and comprehensive tax resources, consider visiting the KPMG website which offers valuable insights on tax strategies and planning.

Key Takeaways on Capital Gains Tax

Understanding capital gains tax is crucial for individuals involved in investing or selling assets. Here are the key takeaways that can help enhance your financial literacy concerning capital gains tax.

Understanding the Different Types of Capital Gains Tax

- Short-Term vs. Long-Term: Always differentiate between short-term and long-term capital gains. Short-term gains are taxed at higher ordinary income rates, while long-term gains enjoy reduced tax rates.

- Exemptions: Familiarize yourself with exemptions available for certain assets, like primary residences, as they can significantly reduce or eliminate your tax liability.

The Importance of Record-Keeping

- Documentation: Maintain accurate records of all transactions involving purchases, sales, and related expenses. Having documentation is crucial for correctly reporting your capital gains tax at tax time.

- Calculate Gains and Losses: Keep a detailed record to easily calculate your gains and losses, helping you take advantage of tax-loss harvesting strategies where appropriate.

Strategies for Minimizing Capital Gains Tax

- Hold Investments Longer: Consider holding assets for over a year to benefit from lower long-term capital gains rates.

- Utilize Retirement Accounts: Take advantage of tax-deferred accounts like IRAs and 401(k)s, where gains can grow without immediate tax consequence.

- Leverage Tax-Loss Harvesting: Actively manage your portfolio by selling losing investments to offset gains, thereby balancing your tax liabilities.

Staying Informed About Changes in Regulations

- Legislative Updates: Tax laws and regulations are subject to change. Keep up with news relating to capital gains tax to adapt your strategies accordingly.

- Seek Professional Advice: Consulting with tax professionals or financial advisors can provide insights tailored to your specific situation, ensuring compliance and optimization of your tax obligations.

For those looking to deepen their understanding of capital gains tax and its implications, the Jackson Hewitt website offers practical resources that can assist you in navigating your tax landscape effectively.

What is capital gains tax?

Capital gains tax is a tax imposed on the profit made from the sale of non-inventory assets, such as stocks, bonds, real estate, or other investments. The amount of tax owed depends on how long the asset was held before selling, with different rates applied to short-term and long-term gains.

How are capital gains calculated?

Capital gains are calculated by subtracting the original purchase price (basis) of the asset from the selling price. Any related expenses, like broker fees or improvements, can also be deducted to arrive at the net gain. This net gain is what is reported and taxed.

Are there any exemptions for capital gains tax?

Yes, there are several exemptions for capital gains tax. One notable example is the primary residence exemption, where homeowners can exclude a certain amount of capital gains from the sale of their home (up to $250,000 or $500,000 for married couples). Other exemptions may apply to collectibles or particular types of investments, so it’s important to consult tax regulations or a professional for specific situations.

How does capital gains tax apply to retirement accounts?

Investments held in tax-advantaged retirement accounts, such as IRAs or 401(k)s, do not incur capital gains tax while the funds remain in the account. However, once you start withdrawing funds from these accounts, the distributions may be subject to ordinary income tax, regardless of whether the gains were long-term or short-term.

Can I offset capital gains with losses?

Yes, you can offset capital gains with capital losses—a strategy known as tax-loss harvesting. If you have realized losses from the sale of other investments, you can use these losses to reduce your overall taxable capital gains, which can lead to a lower tax liability. It’s essential to maintain accurate records to take full advantage of this strategy.

Comments (0)