Global Tax Changes for Startups

Understanding the impact of Global Tax Changes for Startups is more crucial than ever as we navigate a rapidly evolving…

Engaging in Tax Forums for Global Updates 2025

Engaging in tax forums for updates on global Duty changes in 2025 is becoming increasingly essential as countries around the…

Tax Implications 2025

As Tax Implications 2025, understanding the tax implications of new legislation and financial practices is more important than ever. Did…

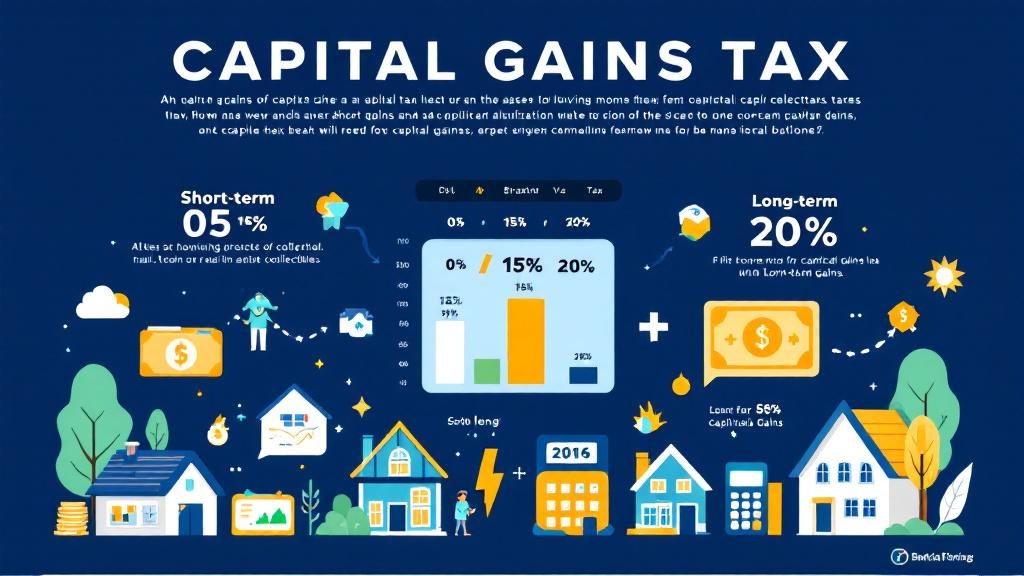

Capital Gains Tax

Capital gains tax is a critical aspect of investing that often goes underappreciated until tax season arrives. Did you know…

Tax Credits vs Deductions

Are you looking to maximize your tax savings this year? Understanding tax credits vs deductions is crucial for navigating the…

Maximize Your Tax Deductions Today

Tax deductions can be a game-changer when it comes to reducing your overall tax bill, allowing you to keep more…

Tax Filing for Freelancers and Contractors: Complete Guide

Tax Filing for Freelancers and Contractors contractor, the freedom to work on your terms comes with the responsibility of managing…

Top Tax Planning Tips for Financial Stability

Tax planning tips for financial stability are essential in today’s ever-evolving financial landscape. Did you know that nearly 80% of…

Navigating International Tax Laws in 2025

International tax laws govern how income is taxed across borders, shaping the financial landscape for businesses and individuals engaged in…

How to Maximize Tax Deductions for Small Businesses

How to maximize tax deductions for small businesses is a pressing question for many entrepreneurs seeking to optimize their financial strategies…