The Goods and Services Tax (GST) system, introduced in India in 2017, has been continuously evolving with regular updates to ensure it remains aligned with the dynamic market demands and government revenue needs. As we head into 2025, the GST rates have undergone significant changes, impacting various sectors and consumer goods. For businesses and consumers alike, understanding these rate changes is crucial to managing costs, complying with regulations, and making informed financial decisions.

In this blog post, we’ll walk you through the latest GST rates for 2025, highlighting the new GST slab rates, changes in GST tax rates by category, and provide detailed insights into GST rate changes in 2025 for different industries. Whether you’re a small business owner, a large corporation, or just a curious consumer, this guide will help you navigate the complexities of the updated GST structure in 2025.

What Are the GST Rates in 2025?

GST rates are essentially tax slabs that the government applies to different goods and services. These rates are categorized into distinct slabs based on the nature of the product or service. The GST rates for 2025 are the result of ongoing government revisions to keep up with inflation, consumer demand, and sector-specific needs.

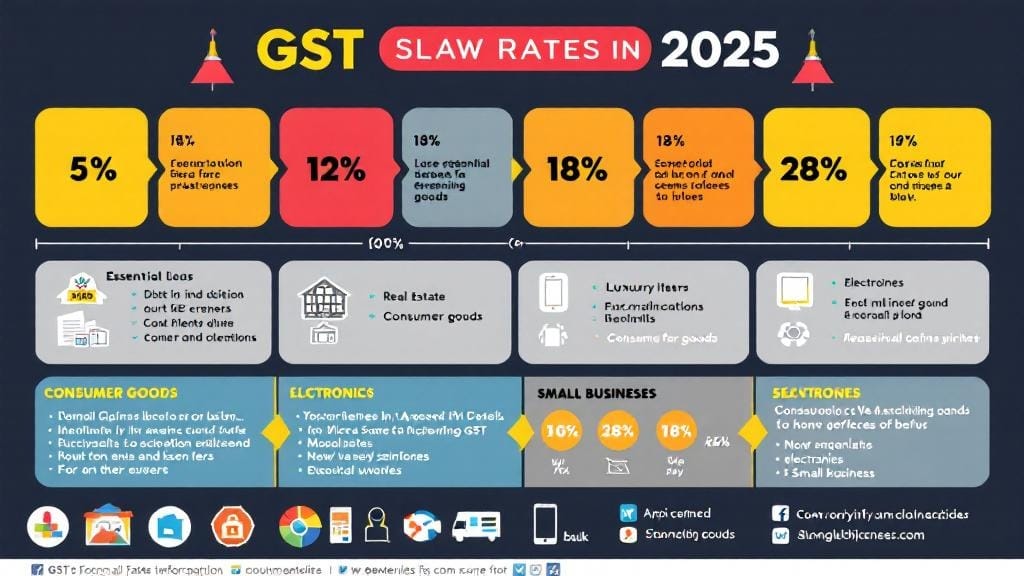

GST Slab Rates 2025

The GST rates are classified into four primary slabs:

-

5% GST Rate: This lower rate applies to essential goods and services. It’s designed to keep taxes on basic necessities manageable.

-

12% GST Rate: Applied to goods and services that are considered intermediate in nature.

-

18% GST Rate: The most common tax rate, applicable to a wide range of products and services.

-

28% GST Rate: The highest tax rate, typically applied to luxury and non-essential goods.

In addition to these, there are exemptions and zero-rated goods where GST does not apply, or is set at a negligible rate. For example, healthcare services, education, and certain agricultural products may fall under these categories.

Key Changes in GST Rates for 2025

There have been several updates to the GST applicable rates in 2025 that businesses and consumers need to be aware of. Let’s dive into the major GST rate changes in 2025.

1. GST Rate Reduction on Consumer Goods

Several essential goods have witnessed a reduction in their GST rates, particularly those related to food, medical supplies, and education. For example, fresh fruits and vegetables that were previously taxed at 5% are now exempt from GST. This reduction is aimed at reducing the financial burden on everyday consumers.

2. GST Rate Increases for Luxury Goods

Luxury goods like high-end electronics, premium cars, and certain designer items have seen an increase in their GST rates. The 28% GST rate now applies more rigorously to these products, aligning with the government’s efforts to tax non-essential, luxury items more heavily.

3. Updated GST Slab Rates for Small Businesses

To ease the tax burden on small businesses, some small-scale industries have seen a reduction in their GST slab rates. Additionally, certain categories have been included in the composition scheme, which allows businesses with annual turnover under a specified limit to pay taxes at a reduced rate.

4. GST Tax Rate Change for Real Estate

The real estate sector has seen significant changes, particularly for residential property. There have been adjustments to both the GST on construction services and GST on under-construction properties. The reduction of the GST rate on affordable housing to 8% has been one of the most notable changes, aimed at making housing more accessible.

Detailed List of GST Rates Applicable in 2025

The updated GST rates list for 2025 is quite comprehensive, covering various categories. Below, we break it down by product and service categories for easy reference.

1. Goods

-

Food and Beverages: Basic food items like rice, wheat, and pulses remain exempt from GST. However, processed food products are taxed at 5% or 12%, depending on the complexity of the product.

-

Clothing and Textiles: Ready-made garments attract 12% GST, whereas textile fabric may fall under 5%.

-

Electronics: Items like mobile phones, televisions, and laptops are now taxed at 18%.

-

Automobiles: Luxury cars and SUVs are taxed at 28%, whereas electric vehicles have seen a reduction in their GST rate to 12% to promote green initiatives.

-

Household Goods: Furniture and home appliances are generally taxed at 18%, but eco-friendly products might see reduced rates.

2. Services

-

Education: Most education services, including primary, secondary, and university education, are exempt from GST. However, private coaching institutes and specialized training services are subject to 18% GST.

-

Healthcare: Medical services, including hospital care and treatment, are exempt from GST. But services like cosmetic surgery and private health clinics could be taxed at 18%.

-

Hospitality and Tourism: The hospitality industry has seen significant changes, with GST on hotel services now varying based on room tariffs. A 12% GST is applicable for rooms priced below ₹1,000 per night, while luxury hotels are taxed at 18% or higher.

-

Real Estate: As mentioned earlier, the GST rate for affordable housing has been reduced to 8%. However, under-construction properties still attract a 5% GST.

3. Exemptions and Zero-rated Items

Some categories are completely exempt from GST, meaning they do not attract any tax. These include:

-

Educational services (non-commercial institutions)

-

Healthcare services (except for private, luxury clinics)

-

Agricultural products (raw food items)

-

Public transport services

How Will GST Rates Change in 2025 for Different Sectors?

The impact of 2025 GST rate changes will vary significantly across sectors. Let’s take a look at the major sectors affected:

1. Small and Medium Enterprises (SMEs)

For small businesses, the GST rate updates for small businesses in 2025 include more streamlined options, such as lower slab rates for those opting for the composition scheme. Many small manufacturers and service providers will benefit from this, as the compliance burden has been reduced.

2. Real Estate

As mentioned, the real estate sector is experiencing the most dynamic changes in 2025. The reduction in GST on affordable housing and the application of lower rates on under-construction properties are designed to encourage more construction, benefiting homebuyers and builders alike.

3. Consumer Goods and Essentials

For consumers, the most significant impact of GST rate changes for 2025 will be on essential goods like food, personal care items, and medical products. With some of these products seeing a reduction in tax rates or even exemption, it’s expected that there will be a decrease in overall consumer costs for many household items.

4. Luxury and Non-essential Goods

The luxury sector will face higher GST rates, especially on items like cars, watches, and premium electronics. This will lead to higher costs for consumers purchasing these high-end products.

FAQs About GST Rates in 2025

Here are some frequently asked questions regarding the GST rates in 2025.

1. What are the new GST rates in 2025 by category?

The GST rates in 2025 are structured into 5%, 12%, 18%, and 28% slabs, depending on the nature of the goods or services. Essential items generally fall under the lower slabs, while luxury goods are taxed at higher rates.

2. How will GST rates change in 2025 for different sectors?

Different sectors, like real estate, consumer goods, and services, have witnessed targeted adjustments. For example, affordable housing has seen a GST rate reduction, while luxury goods have faced higher taxes.

3. Are there any GST exemptions in 2025?

Yes, many basic necessities, such as food grains, healthcare services, and educational services, remain exempt from GST in 2025.

4. How do GST rate changes affect small businesses in 2025?

Small businesses can benefit from lower slab rates and simplified compliance procedures. The composition scheme allows smaller businesses to pay taxes at reduced rates.

5. What is the GST rate on real estate in 2025?

In 2025, affordable housing is taxed at 8%, while under-construction properties attract a 5% GST.

Comments (0)