Choosing the right health insurance plan is one of the most important financial and health-related decisions you can make. With so many options available, the process can feel overwhelming. But fear not, in this article, we will break down the different types of health insurance policies, guide you through the decision-making process, and help you find the best plan suited to your needs and budget.

In this guide, we will cover:

The types of health coverage available.

How to compare different health insurance plans.

Key factors like premiums, deductibles, and network of healthcare providers that influence your decision.

By the end of this article, you’ll be equipped with the knowledge to confidently choose a health insurance policy that provides the coverage you need at a price you can afford.

What Are the Types of Health Insurance Policies?

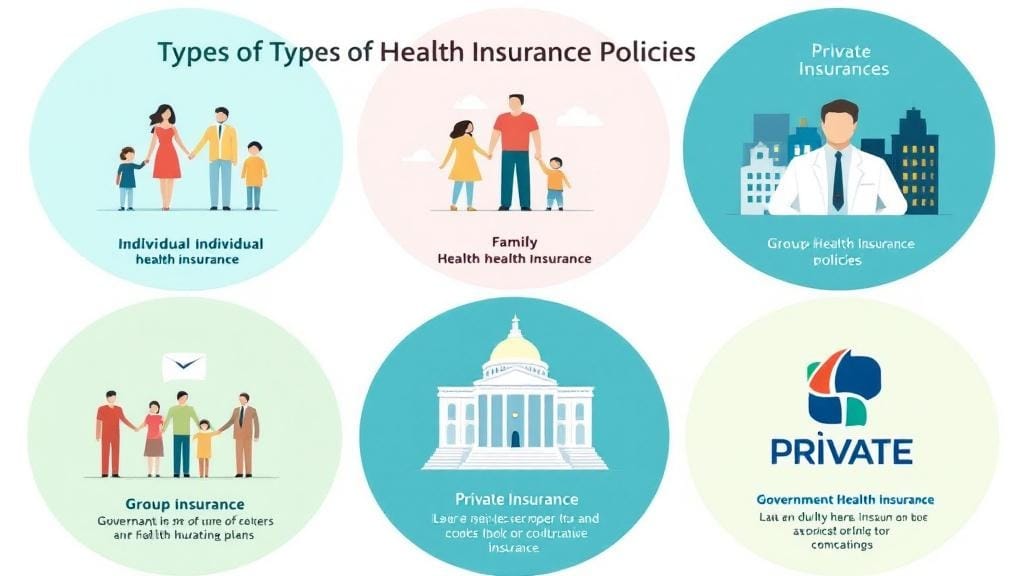

Before diving into the process of choosing a plan, it’s important to understand the different types of health insurance policies available. Each type of health plan offers varying levels of coverage and benefits. Here’s a breakdown:

1. Individual Health Insurance Plans

Individual health insurance plans are tailored to individuals, meaning they cover only you. If you are self-employed, not covered by an employer, or if you need coverage outside of your employer’s offerings, this is a great option.

Pros: Flexible coverage, customizable options, ideal for individuals without employer coverage.

Cons: Higher premiums compared to group plans, limited network options depending on the provider.

2. Family Health Insurance Policies

Family health insurance plans are designed for individuals who need coverage for their spouse, children, or other dependents. These plans can offer significant savings over buying individual plans for each member of the family.

Pros: One plan covers the whole family, potential for discounts or bundled pricing.

Cons: Higher premiums for larger families, coverage may not always be as customizable.

3. Group Health Insurance Options

Offered through employers or large organizations, group health insurance is typically cheaper because the cost is shared among all members of the group. Employers may contribute towards premiums, making it an affordable choice for employees.

Pros: Affordable premiums, employer contribution to costs, wider network of healthcare providers.

Cons: Limited customization, you may need to choose from a set list of plans.

4. Government Health Insurance Plans

Government-backed health insurance plans include Medicaid, Medicare, and CHIP (Children’s Health Insurance Program). These are designed to help individuals and families who meet specific income or age requirements.

Pros: Low-cost or free coverage for those who qualify, comprehensive coverage.

Cons: Eligibility requirements, limited provider network, long wait times for care.

5. Private Health Insurance Policies

Private health insurance plans are offered by companies that are not affiliated with the government. These plans often provide more flexibility than group or government plans, but premiums may be higher.

Pros: Customizable plans, potentially wider healthcare provider networks.

Cons: Higher premiums, additional out-of-pocket costs.

6. Short-Term Health Insurance Plans

Short-term health insurance plans are designed to provide temporary coverage for individuals who are between health plans or need a short-term solution. These plans often don’t cover pre-existing conditions and may have limited benefits.

Pros: Affordable for short-term coverage, quick enrollment.

Cons: Limited coverage, high out-of-pocket costs, and lack of long-term health benefits.

Factors to Consider When Choosing a Health Insurance Plan

Choosing a health insurance policy involves more than just picking the lowest premium. Here are several factors to consider when comparing health insurance plans:

1. Premiums and Health Insurance Costs

Your premium is the amount you pay monthly for your health insurance plan. While a lower premium might sound appealing, you need to weigh this against the plan’s other features, such as deductibles, co-pays, and out-of-pocket costs.

Lower premiums may result in higher deductibles (the amount you pay out-of-pocket before insurance kicks in), which can be a burden if you need frequent medical care.

Higher premiums might offer a lower deductible and more comprehensive coverage, making it easier to manage healthcare costs over time.

2. Deductibles in Health Plans

A deductible is the amount you must pay out-of-pocket for medical services before your insurance starts to pay. When selecting a health insurance policy, consider both the deductible and your ability to pay it in case of emergencies.

High-deductible plans often come with lower premiums but can be costly if you need significant care.

Low-deductible plans offer more predictable out-of-pocket costs but come with higher monthly premiums.

3. Network of Health Insurance Providers

Different health insurance policies have different networks of healthcare providers, which means not all doctors or hospitals may be covered under your plan. Be sure to check that your current doctors and preferred medical facilities are included in the network.

In-network providers will cost you less out-of-pocket.

Out-of-network providers may come with higher costs or may not be covered at all, depending on the plan.

4. Health Coverage Options

It’s essential to evaluate the health coverage options each plan provides. Make sure the plan covers the services that are most important to you, such as:

Emergency care: Coverage for accidents or unexpected illness.

Prescription drugs: Ensure that the medications you need are covered.

Preventive care: Many plans cover annual check-ups, vaccinations, and screenings at no extra cost.

5. Health Insurance Benefits

Health insurance benefits extend beyond medical care. Many plans also provide wellness benefits, mental health services, dental coverage, and vision care.

Make sure the plan you choose covers the benefits most important to you and your family’s health needs.

Health Insurance Policy Comparison: Key Questions to Ask

When evaluating health insurance policy options, it’s helpful to ask yourself a few key questions:

What is my budget?: How much can I afford to pay monthly for premiums? Don’t forget to account for deductibles, co-pays, and out-of-pocket maximums.

How much healthcare do I need?: Do you need regular doctor visits, prescriptions, or frequent medical treatments? If so, a plan with a lower deductible and more comprehensive coverage may be the best option.

Is my current doctor in-network?: If you have a preferred healthcare provider, make sure they are included in the insurance company’s network to avoid paying more.

What is the plan’s prescription coverage?: If you take prescription medications, ensure that the plan covers those medications with reasonable co-pays.

FAQs About Health Insurance Plans

1. What is the difference between government and private health insurance plans?

Government health insurance plans like Medicaid and Medicare are typically for people with low income or those who are elderly or disabled. Private health insurance plans are offered by non-government entities and tend to offer more flexibility, but they may come with higher costs.

2. Are family health insurance policies cheaper than individual ones?

Yes, family health insurance policies typically offer lower premiums compared to buying individual plans for each member of the family, though the cost depends on your family size and specific needs.

3. What is the best health insurance policy for someone with pre-existing conditions?

If you have pre-existing conditions, look for plans that provide coverage for them without exclusions or higher premiums. Affordable healthcare insurance options like those from the Affordable Care Act (ACA) marketplaces are designed to cover pre-existing conditions.

4. What are the benefits of a high-deductible health plan?

A high-deductible health plan (HDHP) can offer lower premiums and might be a good choice if you’re generally healthy and don’t expect to need much medical care. However, you’ll need to be prepared to cover higher costs out-of-pocket before your insurance kicks in.

5. How do short-term health insurance plans work?

Short-term health insurance plans provide temporary coverage, typically up to a year, and are best for those who need short-term insurance between jobs or for other temporary reasons. These plans often offer limited benefits and may not cover pre-existing conditions.

Comments (0)