When it comes to managing your finances, one of the first things you’ll need to consider is choosing the right type of bank account. Among the most common types are current accounts and savings accounts. Although they may seem similar on the surface, they serve distinct purposes and come with various features that cater to different financial needs.

In this guide, we’ll explore the difference between current account and savings account, their features, benefits, and when you should use each. Whether you’re an individual looking for better ways to manage your money or a business trying to decide between the two, this article will break down everything you need to know in simple, clear language.

What is the Difference Between Current Account and Savings Account?

At first glance, the terms current account vs savings account might seem interchangeable, but the difference is quite significant. Here’s a breakdown:

1. Purpose and Usage

-

Current Account: Designed primarily for frequent transactions, this type of account is ideal for day-to-day business or personal use. You can make multiple withdrawals, deposits, and transfers without any limits. It’s perfect for individuals or businesses that need easy access to their funds.

-

Savings Account: This account is meant for saving money over the long term. You won’t typically use it for daily transactions. Instead, it’s a place where you deposit money that you don’t need immediate access to, earning interest on the balance.

2. Transactions

-

Current Account: Offers unlimited deposits and withdrawals, which is why it’s favored for businesses. There may be additional services like overdraft facilities and cheque books.

-

Savings Account: Transactions are typically more limited. You can withdraw money, but there are often restrictions, such as a certain number of free withdrawals per month.

3. Interest Rates

-

Current Account: Generally, current account interest rates are lower or non-existent. This is because it’s not designed for long-term saving, but for frequent use.

-

Savings Account: Savings account interest rates are usually higher, encouraging you to save money over time. These rates can vary depending on the bank and the type of savings account you have.

4. Charges and Fees

-

Current Account: Some current accounts charge monthly fees for maintenance, especially if you have overdraft facilities or other premium features.

-

Savings Account: Savings accounts usually come with lower fees, and some may have no charges at all if you maintain a minimum balance.

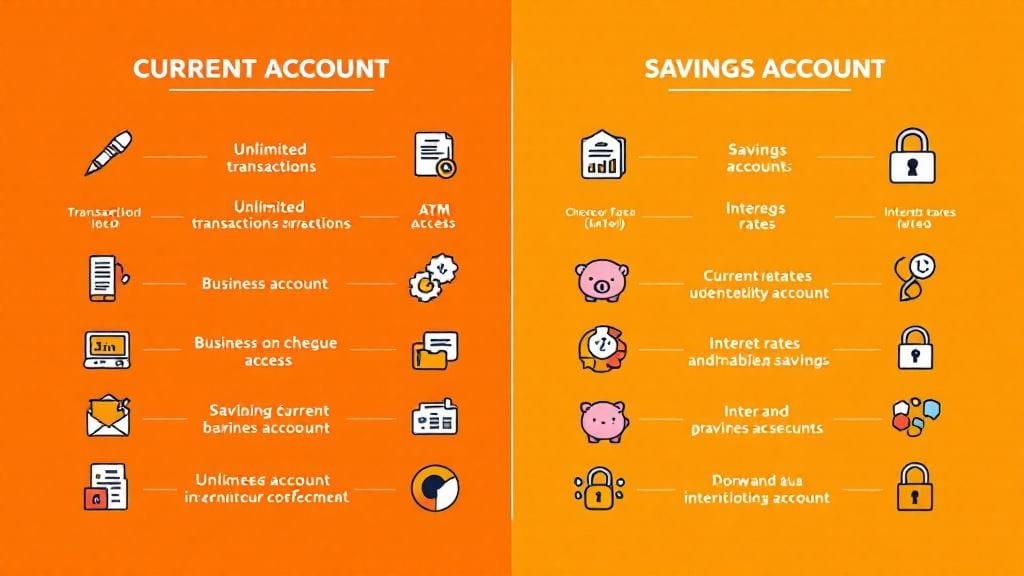

Features of a Current Account vs Savings Account

Understanding the features of a current account and savings account will give you a clearer picture of which one suits your needs best. Let’s dive deeper into what you can expect from each type of account.

Current Account Features

-

Unlimited Transactions: No limits on the number of withdrawals or deposits you can make.

-

Cheque Books: Most current accounts offer cheque books, which can be useful for large transactions.

-

Overdraft Facilities: Some current accounts allow you to borrow money up to a certain limit (the overdraft), often with interest rates.

-

Business Features: Current accounts are tailored for businesses, with features like business payment gateways, employee access, and integration with accounting software.

-

ATM Access: Easy access to funds via ATMs for cash withdrawals.

Savings Account Features

-

Interest-Earning: Your balance earns interest over time, making it a good option for growing your savings.

-

Limited Transactions: Restrictions on how many withdrawals or transfers you can make in a given period.

-

Low Risk: A savings account is typically safer than other investment vehicles, with your funds insured up to a certain amount (depending on the country).

-

Automatic Transfers: Many banks allow automatic transfers from checking to savings accounts, helping you save more consistently.

Benefits of Having a Savings Account Over a Current Account

You might be wondering, “What are the benefits of having a savings account over a current account?” While both accounts have their advantages, the savings account offers certain benefits, particularly for individuals looking to build wealth over time.

1. Higher Interest Rates

Savings accounts generally offer higher interest rates, meaning your money grows faster over time compared to a current account.

2. Safety for Your Funds

In many countries, savings accounts are insured by the government up to a certain amount, ensuring that your money is safe even if the bank goes under. This is not always the case with current accounts.

3. Encourages Saving

A savings account naturally encourages you to save. With limited access to your funds, you’re less likely to withdraw money impulsively, helping you reach your financial goals.

Which is Better, Current Account or Savings Account?

The answer to the question “Which is better, current account or savings account?” depends entirely on your financial goals and needs.

-

If you need quick, easy access to your money and frequently make transactions, a current account is the better choice.

-

If you’re looking to save money over time and earn interest on your balance, a savings account is more suitable.

For most individuals, having both accounts is ideal. You can use the current account for day-to-day transactions and a savings account for setting aside funds for future goals.

Can I Convert a Savings Account Into a Current Account?

It is possible to convert a savings account into a current account in most cases, but it varies by bank. This conversion may require additional documentation and may come with different fees and conditions. If you’re interested in making the switch, it’s best to consult with your bank to understand the process and any potential changes to your account features.

Bank Account Comparison: Current Account vs Savings Account

Here’s a quick bank account comparison of the key differences between current accounts and savings accounts:

| Feature | Current Account | Savings Account |

|---|---|---|

| Purpose | Daily transactions and business use | Saving money with interest |

| Interest Rates | Low or none | Higher interest rates |

| Transactions | Unlimited withdrawals and deposits | Limited withdrawals per month |

| Fees | Possible maintenance fees and charges | Lower fees, often no charges |

| Overdraft | Available in some accounts | Not available |

| Cheque Book | Available | Not available |

| Best For | Daily use, businesses, frequent transactions | Saving, long-term wealth growth |

Frequently Asked Questions

1. What is the difference between current and savings account?

The primary difference lies in their purpose. A current account is for frequent transactions and easy access to funds, while a savings account is meant for saving money and earning interest over time.

2. How do current accounts differ from savings accounts?

Current accounts offer more flexible usage, such as unlimited withdrawals and access to overdraft facilities, while savings accounts limit withdrawals and offer interest to encourage saving.

3. Which bank account is best for businesses, current or savings?

A current account is better suited for businesses due to its features such as unlimited transactions, cheque books, and overdraft facilities.

4. Can I convert a savings account into a current account?

Yes, many banks allow you to convert a savings account into a current account. It’s best to check with your bank for specific details and requirements.

5. What are the charges for current accounts vs savings accounts?

Current accounts often come with higher charges and fees, especially if you opt for premium features or overdraft protection. Savings accounts usually have lower fees, with some offering no charges at all.

6. Benefits of having a savings account over a current account?

The key benefit of a savings account is the ability to earn interest on your balance, which is a great way to grow your money over time.

7. Can I earn interest on a current account?

Some current accounts do offer interest, but the rates are usually lower than those offered by savings accounts.

Comments (0)