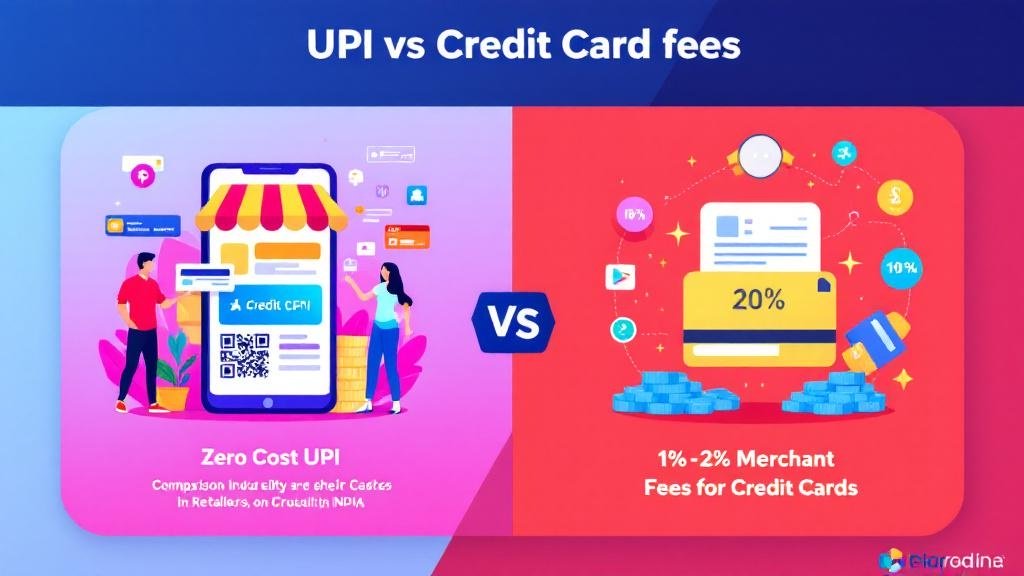

In the evolving landscape of digital payments, retailers in India are constantly exploring payment options that are not only convenient but also cost-effective. Two of the most popular methods for payments are UPI (Unified Payments Interface) and Credit Cards. While both offer significant benefits, they come with their own set of fees and charges, which can make a big difference to your business operations.

In this article, we’ll delve deep into the differences between UPI vs Credit Card Charges, analyze the pros and cons of UPI vs card payments, and give you a clearer understanding of what could work best for your business.

UPI vs Credit Card Fees: Which Payment Works Best for Retailers?

Digital payments have revolutionized the way transactions are done in India. With the surge in mobile wallet usage and online payment solutions, both UPI and Credit Cards have emerged as key players. But, which payment option should retailers prefer? Let’s compare both options in detail.

1. UPI Payments: The Future of Digital Transactions

Unified Payments Interface (UPI) has quickly become a leading method for making payments in India. Developed by the National Payments Corporation of India (NPCI), it allows for real-time money transfers between banks without the need for a credit card or debit card.

UPI Fees in India:

One of the most appealing aspects of UPI is its low-cost nature. UPI payments are often free for consumers and come with negligible fees for businesses. As per NPCI guidelines, the UPI system enables merchants to receive payments at zero or very minimal charges, which makes it an attractive option for small businesses.

-

Merchant Fees for UPI: Typically, there are no charges for receiving UPI payments from customers. This is a key advantage over traditional card payments.

-

UPI vs Card Payments in Terms of Cost: While UPI payments are cost-effective, credit card payments generally come with higher merchant fees, especially when you factor in payment gateway fees and transaction charges.

Advantages of UPI Payments:

-

Zero Cost for Merchants: No fees for retailers when accepting payments via UPI.

-

Instantaneous Payments: Real-time payments, making it ideal for quick transactions.

-

Secure Transactions: UPI offers enhanced security protocols, ensuring that transactions are safe.

-

Financial Inclusion: UPI has made payments accessible to people without credit cards or bank branches.

Disadvantages of UPI Payments:

-

Limited International Reach: UPI transactions are primarily restricted to India, making it unsuitable for international transactions.

-

Transaction Limits: UPI has certain transaction limits, which may be restrictive for large retailers or high-value transactions.

2. Credit Card Payments: The Classic Choice

Credit cards are one of the most widely accepted methods of payment globally. With the RBI payment regulations in place, credit card payments in India are secure and reliable.

Credit Card Payment Fees:

Credit card payments tend to incur higher fees for retailers, especially when using payment gateways or third-party platforms for transactions.

-

Merchant Fees for Credit Cards: Credit card companies charge retailers anywhere from 1% to 2% of the transaction amount as merchant fees. These fees can add up, especially for businesses processing a large volume of transactions.

-

Credit Card Payment Gateway Fees: In addition to merchant fees, retailers also incur payment gateway charges, which can range from 0.5% to 1.5% of each transaction.

Advantages of Credit Card Payments:

-

Global Reach: Credit cards are accepted internationally, making it ideal for businesses dealing with global customers.

-

High Transaction Limits: There are no transaction limits like those imposed on UPI.

-

Convenience: Credit cards are a convenient option for customers, especially when making larger purchases.

Disadvantages of Credit Card Payments:

-

Higher Merchant Fees: As mentioned earlier, credit card payments come with higher fees than UPI payments.

-

Transaction Time: Credit card payments can take longer to process compared to instant UPI transactions.

Comparing UPI vs Credit Card Payments for Retailers

Let’s compare UPI payment vs credit card payment across several important factors.

| Factor | UPI Payments | Credit Card Payments |

|---|---|---|

| Fees for Merchants | No or very low fees | Higher fees (1%–2% per transaction) |

| Transaction Speed | Instantaneous | May take a few seconds to a minute |

| Security | Highly secure with encryption and OTPs | Secure but can be vulnerable to fraud |

| International Acceptance | Limited to India | Widely accepted worldwide |

| Transaction Limits | ₹1,00,000 per day (current limit) | No set limit, but credit card limits apply |

| Ideal for | Small businesses, small-ticket transactions | Large retailers, high-ticket transactions |

Why Do Merchant Fees Matter?

Understanding merchant fees is crucial when choosing the best payment method for your retail business. Every time a customer pays via credit card, the retailer has to pay a percentage of the transaction to the bank or payment processor. This adds up over time, especially if your business processes high volumes of transactions.

On the other hand, UPI remains a preferred choice for small and medium businesses in India, thanks to its zero-cost structure. The absence of payment gateway fees or transaction charges makes UPI a more economical option for Indian retailers.

The Role of Payment Gateway Fees in India

When retailers opt for online transaction charges UPI vs credit card comparison, they must also take payment gateway fees into consideration. Payment gateways often charge for processing credit card transactions, which can make card payments more expensive. This is especially true for foreign card payments, where additional conversion and processing fees are involved.

In contrast, UPI payments are handled directly through bank apps or mobile wallets, without the need for a third-party payment processor. This makes UPI payments more cost-effective for retailers.

UPI vs Credit Card: Pros and Cons

UPI Payments: Pros

-

Zero transaction charges for merchants.

-

Instantaneous payments, offering quick cash flow for businesses.

-

Supported by the NPCI, making it a trusted and regulated payment method.

-

No additional payment gateway fees.

UPI Payments: Cons

-

Limited to Indian residents and domestic transactions.

-

Transaction limits on high-value payments.

-

Lack of support for international transactions.

Credit Card Payments: Pros

-

Widespread acceptance internationally.

-

No transaction limits, making it ideal for large purchases.

-

Customer familiarity with credit card payments, leading to better convenience.

Credit Card Payments: Cons

-

Higher merchant fees and payment gateway charges.

-

Slower processing compared to UPI.

-

Potential for credit card fraud.

FAQs About UPI vs Credit Card Payments for Retailers

1. Are there any hidden fees for UPI payments in India?

No, UPI payments in India are typically free for both consumers and merchants. However, there may be charges for specific services like cash withdrawals or using a third-party payment gateway.

2. What are the fees for accepting credit card payments?

Credit card payment fees for merchants range from 1% to 2% of the total transaction amount. Additionally, payment gateway fees can add another 0.5% to 1.5%.

3. Which payment method is faster: UPI or Credit Card?

UPI payments are processed almost instantly, while credit card payments can take a few seconds or longer, depending on the processing time.

4. Are there any international payment options available with UPI?

Currently, UPI is primarily for domestic transactions and does not support international payments. However, credit cards are accepted worldwide.

5. What are the security measures for UPI and Credit Card payments?

Both UPI and credit card payments are highly secure, with features like encryption, OTP (One-Time Password), and fraud detection systems to ensure safe transactions.

Conclusion: Which Payment Option is Right for Your Business?

Choosing between UPI vs credit card payments depends on your business needs. If you’re a small business or retailer in India, UPI is likely the best choice due to its low-cost structure and instant transaction features. However, if you are dealing with international customers or high-value transactions, credit cards might offer more flexibility.

By understanding the merchant fees, transaction speed, and security features of each payment method, retailers can make a more informed decision that benefits both their business and their customers.

Comments (0)