In today’s digital age, transferring money has become easier than ever. Thanks to various payment systems available in India, users can transfer money between banks instantly, securely, and conveniently. Among the most commonly used methods are UPI, NEFT, and IMPS. But how do these systems differ from each other? What should you consider when choosing the best method for your needs? Let’s break down these payment options, compare their features, and guide you toward making the best choice.

What Are UPI, NEFT, and IMPS?

Before diving into the differences, let’s define each of these payment systems:

-

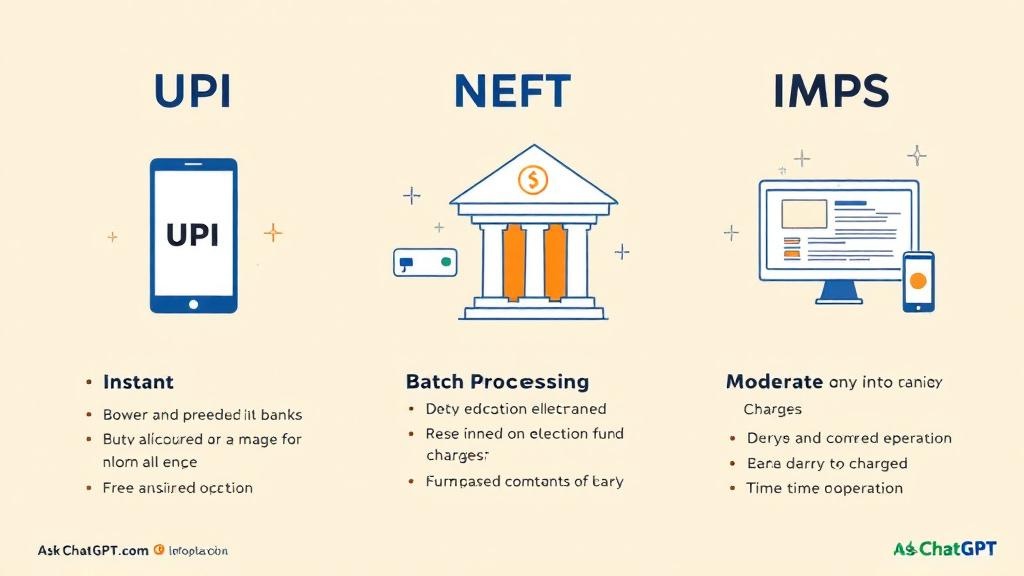

UPI (Unified Payments Interface): UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI) to facilitate interbank transactions. It allows users to transfer money instantly between different banks using mobile apps. UPI is the most popular and widely used system, with millions of users relying on it for daily transactions.

-

NEFT (National Electronic Funds Transfer): NEFT is an electronic payment system that enables individuals and businesses to transfer funds between different banks in India. However, unlike UPI, NEFT is not available for instant transfer; it operates in batches and has specific working hours.

-

IMPS (Immediate Payment Service): IMPS is another real-time interbank payment system that enables users to send money instantly. It was introduced by NPCI to provide 24/7 fund transfer options, even on holidays.

Key Differences Between UPI, NEFT, and IMPS

1. Transaction Time: Speed Matters

-

UPI: Instant transfer of funds, making it the fastest among the three. Transfers occur in real-time, and the recipient receives the funds immediately.

-

NEFT: The transfer takes time because it works in batches. Transactions are processed every hour during working hours (usually from 8:00 AM to 7:00 PM on weekdays and 8:00 AM to 1:00 PM on Saturdays). NEFT does not operate on Sundays or public holidays.

-

IMPS: Instant transfers, similar to UPI. You can transfer funds 24/7, including weekends and holidays, which is a significant advantage over NEFT.

2. Transaction Limits

-

UPI: UPI has a transaction limit that typically ranges from ₹1,00,000 to ₹2,00,000 per day, depending on the bank and user’s profile. It is sufficient for daily payments like bill payments, peer-to-peer transfers, and small business transactions.

-

NEFT: There is no upper limit on the amount you can transfer using NEFT. However, individual banks may impose a daily limit depending on the type of account.

-

IMPS: IMPS has a lower limit than NEFT but is typically sufficient for everyday transactions. Most banks allow transfers up to ₹2,00,000 per day, though limits can vary based on the account type.

3. Charges: Which System is the Cheapest?

-

UPI: UPI transactions are usually free for both the sender and the receiver. It’s one of the main reasons for its widespread popularity.

-

NEFT: NEFT charges are relatively low but depend on the amount being transferred. The fee may range from ₹2.5 to ₹25 for small amounts, but the charges are waived for larger transfers.

-

IMPS: IMPS also charges fees, but they’re usually higher than UPI. The cost can vary between ₹5 to ₹20, depending on the bank and transaction amount.

4. Security: Keeping Your Money Safe

-

UPI: UPI uses two-factor authentication, including a UPI PIN (Personal Identification Number). Transactions are encrypted to prevent fraud and unauthorized access.

-

NEFT: NEFT requires users to input bank account details, IFSC codes, and sometimes OTPs (One-Time Passwords) for validation. It also uses encryption and other security features.

-

IMPS: IMPS also employs two-factor authentication and is considered to be secure. However, due to the availability of real-time transfers, it is important to be cautious when using IMPS for large amounts.

5. User Experience: Accessibility and Convenience

-

UPI: UPI is available via multiple mobile apps, such as Google Pay, PhonePe, and Paytm, offering a seamless experience. It allows users to transfer money directly from their bank account without needing to know the recipient’s bank account details.

-

NEFT: NEFT requires you to know the recipient’s bank account number and IFSC code. It is typically done through the bank’s online banking portal, mobile app, or at the bank branch.

-

IMPS: Like UPI, IMPS can be accessed through mobile banking apps or internet banking platforms. It requires the recipient’s mobile number or account details.

When Should You Use UPI, NEFT, or IMPS?

To make the best choice, consider the following factors:

-

For Instant Transfers: UPI and IMPS are your best bet. While both allow immediate transfers, UPI is more popular for small payments, while IMPS is suitable for larger transfers.

-

For Transfers Outside Banking Hours: IMPS is the most reliable choice because it operates 24/7, including on holidays.

-

For Large Amounts: NEFT is ideal for larger transfers, as it has no upper limit (compared to UPI and IMPS). However, keep in mind that NEFT is not immediate.

-

For Convenience: UPI wins here, thanks to its seamless integration with mobile apps and its ease of use.

UPI vs NEFT vs IMPS: Which Is the Best for Your Needs?

Here’s a quick summary to help you decide the best payment method for your needs:

| Payment Method | Transaction Time | Limits | Charges | Security |

|---|---|---|---|---|

| UPI | Instant (24/7) | ₹1,00,000 to ₹2,00,000/day | Free | High |

| NEFT | Batch processing (Working hours) | No upper limit | Low | High |

| IMPS | Instant (24/7) | ₹2,00,000/day | Moderate | High |

FAQs About UPI, NEFT, and IMPS

1. What is the primary difference between UPI and NEFT?

-

UPI is faster and operates in real-time, while NEFT works in batches and only during specific hours. UPI is free, while NEFT incurs small charges based on the transaction amount.

2. Is UPI the best option for sending money instantly?

-

Yes, UPI offers the fastest transactions for small to medium-sized amounts, and the transfers happen instantly.

3. Which payment method is best for large fund transfers?

-

For larger amounts, NEFT is better, as it has no upper limit. IMPS is also an option but has a lower limit compared to NEFT.

4. Can IMPS be used for business payments?

-

Yes, IMPS can be used for business payments and transfers, especially if you need to send money outside of regular banking hours.

5. Are there any security concerns with UPI, NEFT, and IMPS?

-

All three methods employ robust encryption and authentication measures, making them secure for transferring funds. However, it’s essential to ensure you are using trusted apps and websites.

6. Which is better for instant payments – UPI or IMPS?

-

Both UPI and IMPS offer instant payments, but UPI is more popular for mobile app-based transactions and peer-to-peer transfers, while IMPS is better for larger transfers.

7. Can I send money to an international account using UPI, NEFT, or IMPS?

-

Currently, UPI, NEFT, and IMPS only facilitate domestic transfers. For international transfers, you would need to use services like SWIFT or wire transfers.

Conclusion: Choose the Right Payment Method for Your Needs

In the battle of UPI vs NEFT vs IMPS, the best method depends on the type of transfer you need to make. For quick, real-time payments, UPI is the winner, especially for smaller transactions. If you need to send large sums or transfer funds during non-banking hours, IMPS or NEFT would be better suited for your needs. Each payment system has its own set of benefits, so choose wisely based on your requirements.

By understanding the key differences, you can make smarter decisions when managing your money, whether you’re paying for services, sending money to family, or conducting business transactions.

Comments (0)